Native Tax Exemptions Hurting Small Business

$69.2 million paid back to Indian bands in provincial fuel and tobacco taxes

Fuel tax rebates up 319%, tobacco tax rebates up 1643% since 2000

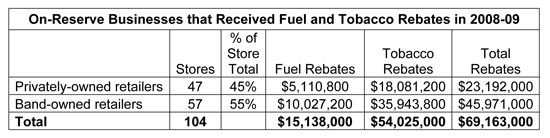

REGINA: The Canadian Taxpayers Federation (CTF) is calling on the provincial government to eliminate race-based tax exemptions, in light of new figures obtained through Freedom of Information. In 2008-09, businesses located on reserves in Saskatchewan received $54 million in provincial tobacco tax rebates and $15 million in fuel tax rebates. Non-reserve businesses do not have this unfair, race-based tax rebate.

“Reserve businesses not having to pay taxes creates an unfair playing field. It’s extremely difficult for non-reserve businesses to compete,” said CTF-Saskatchewan director, Lee Harding. “It’s no wonder the Shell station at Angus Street and Dewdney Avenue recently closed.”

Harding released the figures today at Sonshine Car Wash and Gas in North Central Regina. The business operates just a few blocks away from the Piapot urban reserve. Dion MacArthur, owner of Sonshine Car Wash and Gas, estimates that cigarette sales have dropped 75 per cent and overall sales 25 per cent, since the Piapot band opened the Cree Land Mini-Mart.

“With provincial gas taxes at 15 cents per litre and cigarette taxes at $4.58 per pack, it is impossible for an off-reserve business to compete for Indian customers,” continued Harding. “Tax-free status also means lower overhead costs, giving a competitive advantage to capture the non-native market as well.”

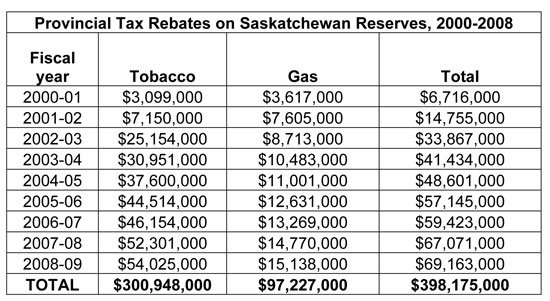

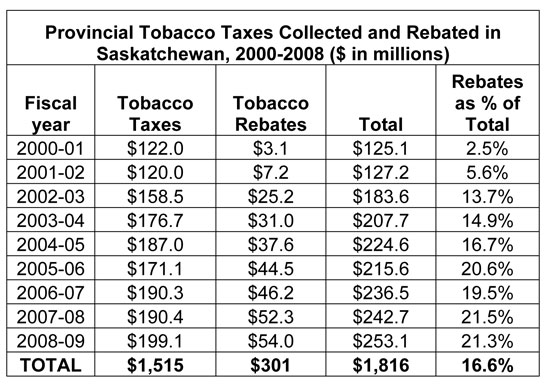

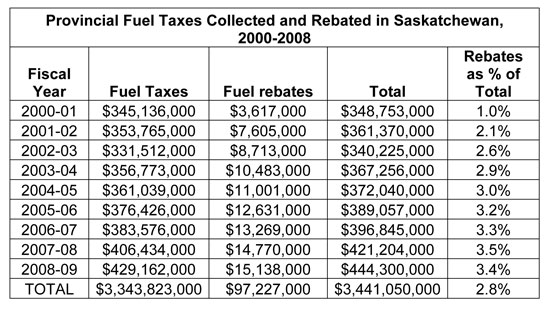

Since the introduction of the provincial gas and fuel tax rebate program in 2000, native bands have seen the fuel rebates increase from $3.6 million per year to $15.1 million this past year. More significant is the rise in tobacco rebates of $3.1 million in 2000 to $54 million today. One in five tobacco tax dollars collected by the province are rebated back to Indian bands.

“Now that an urban reserve has been introduced to Regina and with more on the way, these figures will only rise,” said Harding.

“It would be great if we could all be exempted from taxes. Until then, all Canadians, regardless of where they live, or their race, should conduct business and pay taxes under the same rules,” Harding said. “Tax exemptions for reserves are not found in the treaties, but in Section 87 of the Indian Act. The province should eliminate its on-reserve tax exemptions and push the federal government to do the same.”

Backgrounder: Stats on Provincial Fuel and Tobacco Tax Rebates.

Sources: Access to Information, Saskatchewan Public Accounts, CTF calculations.